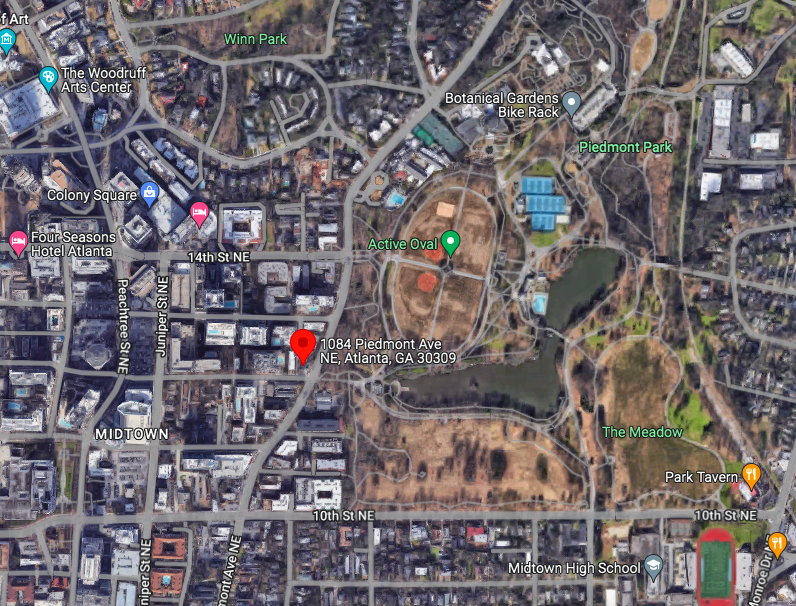

The developer behind the planned redevelopment of the Master Mind Thinker Building in Midtown Atlanta is headed before a neighborhood planning group with a new vision, one that no longer includes the office building with the thinker painted on its facade.

Tenth Street Ventures plans to reduce the size of its planned mixed-use tower from 20 to 17 stories, push back its L-shaped project by 20 feet from the historic Winnwood Apartments, cut the number of residential units and, most prominently, raze the current 15K SF office building, known as the Master Mind Thinker Building. The plans were made public on the agenda for the Midtown Development Review Committee meeting Tuesday.

Tenth Street principal Brian McCarthy told Bisnow that the decision to tear down the existing office building came after hearing feedback from neighborhood and community members who didn’t feel the structure needed to be preserved in the redevelopment.

“They didn’t say that we should tear it down, but they said it wasn’t important to keep it,” McCarthy said.

Tenth Street previously planned to repurpose the Master Mind building, built in 1958 and renovated in 2001, into the new project at 1450 West Peachtree St. as its lobby and retail section. The developer was pursuing a variance in order to keep the existing office building, but now that it is to be torn down, that variance approval is no longer needed, McCarthy said.

The changes come after Tenth Street received neighborhood pushback on its initial design, including criticism from Atlanta Preservation Center Executive Director David Mitchell, who said last year that it would “besiege” the Winnwood Apartments, one of the last remaining buildings in Atlanta designed in a Georgian Revival style. Mitchell said the plan was “lamentable” for failing to focus on preservation and not involving more civic engagement.

“The style I was going for is not the style they were looking for,” McCarthy said.

Midtown Neighbors Association President Courtney Smith, who chairs the neighborhood planning unit where this project is located, declined to comment on the revisions made by Tenth Street.

“I am going to hold comment until after the revised plan presentation at the DRC tomorrow. Then we will be fully aware of the context for the new site plan,” Smith told Bisnow in an email. “This project will certainly receive extensive discussion. We have received a number of statements from community members and advocacy groups.”

McCarthy said other changes to the project, plans for which were first reported by Bisnow, were done in consideration of the Winnwood Apartments, including reducing the height of the building, scaling back the number of residential units from 332 to 288 and shrinking the total size of the parking deck.

Winnwood is owned by Atlanta-based Urban Landings, a firm that formed in 2021 after four managing partners of Tenth Street left to partner with GBX and Easements Atlanta. Urban Landings plans to renovate the 90-year-old Winnwood property — listed on the National Register of Historic Places — into 50 affordable micro-apartments.

“From the concerns from the community, we redesigned the parking deck so it’s not as overwhelming,” he said. “Ultimately, trying to make it fit more what the community wanted.”

But McCarthy said in order to reduce the parking deck’s size, he now has to rely on a unique design — a deck with only one driveway, where monitors inform drivers who can go up or down at any given time.

“It’s going to be very technologically based where you have to go one car one at a time. We have the same amount of parking that we have before, but the architect was able to come up with this incredible concept,” McCarthy told Bisnow. “It’s like an HOV lane. People will be able to go one way at a time and pause each way they go down. Technologically, it’s 100% able to happen. It’s about the timing and when you move in and move out.”

McCarthy said that the smaller parking configuration shrinks the overall development cost from the initial $120M price tag to $100M.

Some 30% of the 139 residential units are expected to be reserved for renters earning up to 80% of area median income, which is around $48,300 for one person, according to Invest Atlanta. McCarthy said the building will still have a coworking space, a fitness center and a café. The developer also is maintaining the 149 hotel/short-term rental units in the project, according to the agenda.

Tenth Street heads before the review committee at 5 p.m. Tuesday.

January 9, 2023