Five years ago, a New York developer bought a plot of land in Midtown Atlanta, declaring its intentions to build the tallest residential tower in the Southeast, with prices and finishes more in line with Midtown Manhattan.

Brokers for the project — called No2 Opus Place — say they have dozens of buyers who have committed to buying units in the building, some of which are being offered for north of $10M.

But many real estate brokers and experts who Bisnow spoke to have doubts that it will ever get built.

ArX Solutions Rendering for the proposed No2 Opus Place, designed by Perkins+Will and being developed by Olympia Heights Management

Several announced dates for an official groundbreaking have come and gone, the developers continue to refinance the land with short-term loans, and the construction firm working on the site told Bisnow there are no plans to go vertical anytime soon.

“Opus, which we call ‘Nopus,’” said Jeffrey Taylor Johnson, the founder of Above Atlanta Brokers, among the top condo brokerage firms in Atlanta. “It’s a joke.”

After purchasing the property at 98 14th St. for $22M in 2014, developer Olympia Heights Management has reshaped plans for the project three times. In the latest iteration, unveiled last year, Olympia Heights envisions a 53-story building with 182 condominium units and more than 200K SF of office space, still the tallest residential tower in Atlanta at 730 feet.

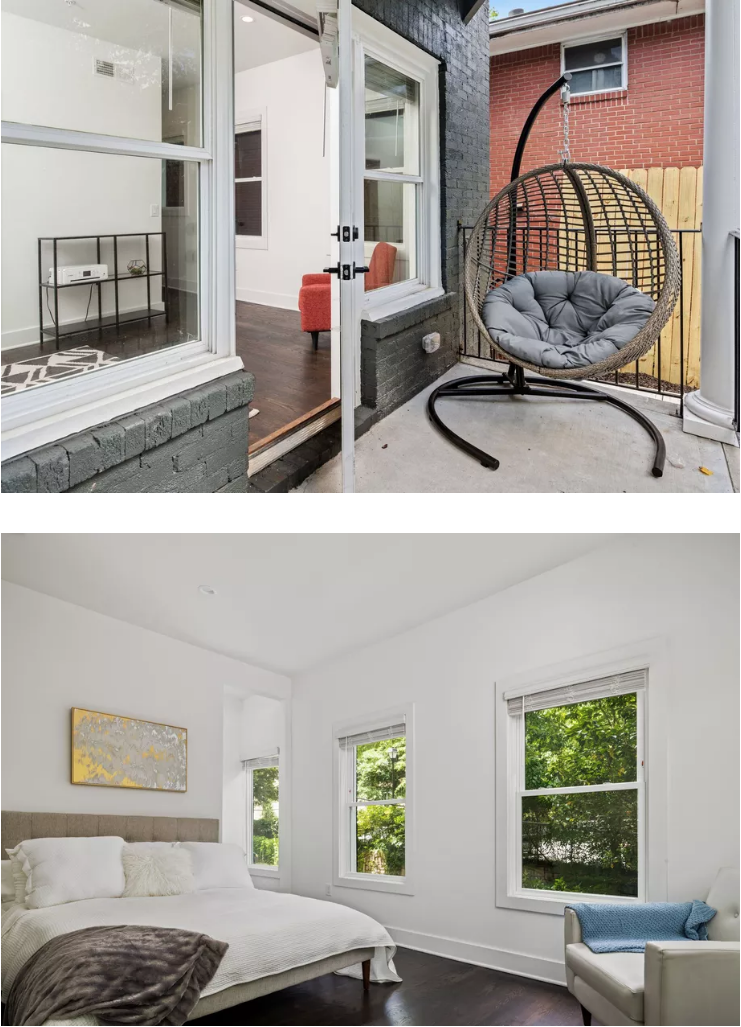

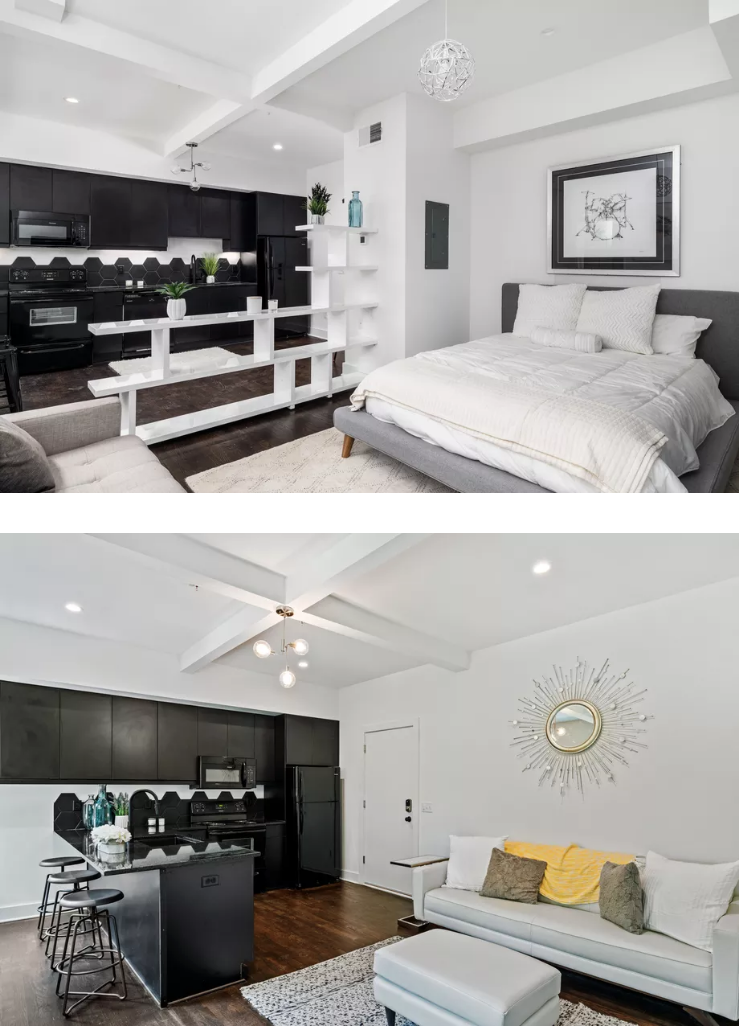

No2 Opus Place could be the project that gives Atlanta one of its first glimpses of luxury and lifestyle typically found in markets like New York, Tokyo, Miami or Los Angeles. Its residents would have sweeping views of Midtown and Downtown Atlanta and access to a resort-style pool, high-end restaurants, a spa, a wine tasting and storage room, an IMAX theater and 24-hour concierge services.

Since buying the land and announcing the ambitious project, the New York developer behind Olympia Heights was investigated by the attorney general in his home state for fraud and shoddy workmanship on several condo developments. Three years ago, he agreed to a two-year ban from selling condos in a deal with the attorney general.

That developer, Shaya Boymelgreen, built thousands of luxury apartments in Manhattan and Brooklyn in the 1990s until his business essentially collapsed amid the Great Recession.

Olympia Heights has maintained that the building is moving forward, and that they have pre-sold dozens of units. It still predicts a 2021 opening, despite the fact that foundation work has not yet begun. But the development team’s shifting dates and marketing tactics have led some buyer’s agents in Atlanta to steer their customers clear.

“I don’t think that project is viable,” a local broker told Bisnow. “Because it just doesn’t seem to go anywhere, and the story changes all the time.”

A Luxurious Plan

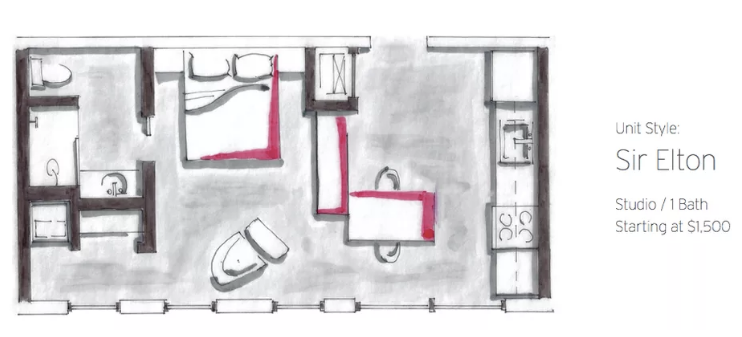

The $3M sales center operated by Berkshire Hathaway and Olympia Heights

Olympia Heights spent $3M building out No2 Opus Place’s sales center, located on the property, which contains a wall filled with video screens showing models of the skyline views, inside a model of a condo unit.

The units are being designed by Champalimaud Design, which has designed condos and hotel rooms for the Waldorf Astoria and The Plaza in Manhattan and Ritz-Carltons and Four Seasons overseas. They range from one to three bedrooms, with Falakron marble countertops and backsplashes, Miele appliances and airy and spacious bathrooms lined with marble.

Residents in the building would be members of The Opus Club, a three-story amenity with two pools, a wellness center, a spa and Mozart’s 41st, “the ultimate lifestyle club with private lounges, chef’s table, and screening room,” according to the project’s website.

Asking prices in the building, designed by Perkins+Will, range from $600K to $12M, according to Berkshire Hathaway’s website. Prices start around $600 per SF for lower-level units, but will rise to above $1K per SF for the homes closer to the top.

The prices Olympia Heights is targeting have rarely ever been achieved in Metro Atlanta, a market where the average first-generation condo unit sells for around half as much per foot, Engel & Volkers CEO Christa Huffstickler said. On the highest end, condos have sold for $800 per SF, she said.

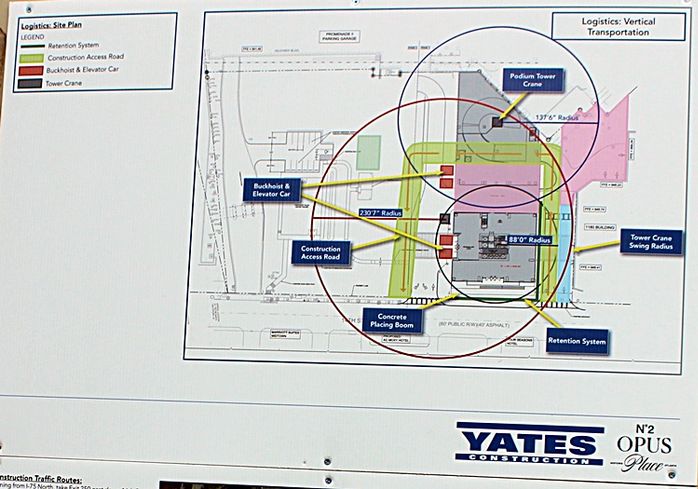

A poster hanging on a construction trailer at the No2 Opus Place site details where cranes will be positioned for future construction.

JPX Works founder Jarel Portman knows the difficulties of getting a luxury condo project off the ground in Atlanta.

His firm pursued a project in Buckhead called Emerson. He designed the 41-unit project with the influence of Frank Lloyd Wright’s Fallingwater and chased a price point of $1,100 per SF. Units in the building started at $2M.

Portman was a known quantity in Atlanta. He is the son of the late, renowned architect and developer John Portman, and has developed two successful commercial projects in his own right: the mixed-use Inman Quarter project and the Lili apartment tower. But even after pre-selling 32% of the units, JPX Works was unable to land financial backing to go vertical.

In 2018, Portman pulled the plug on the project and sold the land to another developer.

“Clearly, we thought Emerson was going to be sold out even before we opened the design office, but maybe that’s because we fell in love with the design,” Portman said. “It’s very difficult to build the kind of product that we were trying to build and [the No2 Opus Place developers] say they’re trying to build in Atlanta right now.”

Stuck In The Ground

A digger was excavating Olympia Heights site in Midtown in early June

Stolz Partners founder Will Stolz, who is developing two luxury condo projects in Texas, said lenders today typically require between 40% and 50% of the proposed units locked in, with buyers putting down at least 10% of the purchase price before granting construction funding.

He sold half the units of his Giorgetta project and 40% of the units on The Sophie, both mid-rise projects in Houston, before securing construction financing, he said. Convincing customers to buy units before any actual construction begins is difficult, and can make pre-sales slow going, Stolz said.

“If you’re realistically doing one a month, then you’re doing as well as you can expect to be doing,” he said. “Now in a high-rise, that could change. You could pro forma more aggressive absorption in a high-rise.”

Despite having financed projects for Olympia Heights in the past — including an apartment project in Brooklyn and an office project in Nashville — Terra Capital Partners Managing Director Dan Cooperman said Terra has no interest in financing the construction of No2 Opus Place.

Terra Capital previously held the mortgage on the property for two years prior to Ardent Cos., which currently owns the debt on the land.

“I think we saw a package from a broker on it,” Cooperman said. “But we’ve done a number of deals with them, and we’ve been in that land for a couple of full years and we sort of went full circle on it, and that was a good result for us.”

Cooperman said it will be difficult for Olympia Heights to find construction financing for their project, especially at their hoped-for price point.

“The for-sale market in Florida or New York is one that is much more sort of proven,” he said. “So I think the condo component and the size make this a challenge from a financing standpoint for the best of developers.”

At the end of 2018, there were 82 condo projects on the market in Atlanta, either under construction or delivered, according to multifamily tracking firm Haddow & Co. Nearly 40% of the more than 4,100 units in those projects remained unsold.

In No2 Opus Place’s neighborhood, Midtown Atlanta, there were nine active condo projects and more than 400 unsold first-generation units, Haddow & Co. reported. Of those, 64 were under contract by year’s end. Haddow & Co. Managing Partner Ladson Haddow said that No2 Opus Place is not tracked among those statistics since it has not officially gone under construction.

Olympia Heights’ plans for 182 condos are part of the submarket’s 407-unit future pipeline. On May 13, Olympia Heights’ Roni Avraham — who is spearheading the development in Atlanta — told Bisnow the developer had pre-sold 70 units, which would be 38% of its proposed stock.

Olympia Heights’ debt on the property is coming due shortly. The developer secured a loan for $22M from Ardent Cos., which matures in January 2020. It has an option to extend the maturity date by three months, according to Fulton County deed records. Officials with Ardent declined to comment.

The Ardent loan refinanced Olympia Heights’ previous loan with New York-based Terra Capital Partners. It initially borrowed $24.5M in 2017, and in June 2018, Olympia Heights refinanced that loan with Terra, this time for $27.5M, which matured at the end of the year, according to Databank. That loan was fully satisfied, Cooperman said.

Courtesy of Mark Toro View from a balcony at The Four Seasons in Midtown Atlanta

Moving Targets Throughout all this time, Olympia Heights officials have publicly insisted its project would deliver by 2020, even as the dates for construction’s start shifted in the media and its overall plans changed.

In various media reports, Olympia Heights offered various dates that construction would begin:

In July 2016, What Now Atlanta reported construction was to start that fall.

In February 2018, Atlanta Magazine reported that the firm had short-listed general contractors and would likely break ground later in the year.

In a May 2018, Avraham told Curbed Atlanta that the developer would start going vertical in September or October.

In February of this year, Atlanta Magazine reported that construction would start in the middle of this year with delivery now pegged for 2021. Midtown Alliance’s website, which tracks new commercial developments in the area, shows No2 Opus Place as “under construction,” having started in 2017 and finishing in 2020.

When Olympia Heights first announced plans in 2014 for the project on the site, which was once targeted by the Atlanta Symphony Orchestra for a potential new music hall, the developer envisioned a three-tower project that would include a hotel and a condo skyscraper that would rise 60 stories, the tallest building in the Southeast, surpassing Bank of America Plaza.

Since then, Olympia Heights has tinkered with its plans, condensing the project into a single tower, nixing a hotel component, reducing the height to 53 stories, shrinking some of the units and capping the project at 182 condos.

When asked about when the firm would break ground, Avraham told Bisnow, “You should see some action next week. Probably [in] June, July, we’re going to start with the foundation.”

Since that brief May 13 exchange, in which Avraham said to have pre-sold more than a third of the units in the project, he has not responded to multiple calls and emails from Bisnow seeking comment for this story.

It is difficult to verify pre-sales in Georgia. A sale is not typically recorded in local deeds until it is fully consummated, according to Haddow.

Earlier this month, Berkshire Hathaway HomeServices Managing Broker Lori Lane, who is leading sales marketing efforts for No2 Opus Place, told Bisnow that she would provide an update that’s “really positive” after a meeting with stakeholders in the project over the past week. She also said the sales team “met our quota” with pre-sales, describing them as traditional.

“[The buyers] all put money down,” Lane said, but couldn’t verify how many buyers put down hard money or refundable deposits.

After that meeting, in an email June 19, Lane wrote, “the sales team is not able to answer questions as much as they would like to … I can tell you everything is moving forward and we are very excited about the future of No2 Opus Place … If you can bear with us I will make sure you get the accurate info when I have it to share.”

Bisnow Yates Construction inserted a trailer and installed fencing around the site that is being pushed by Olympia Heights for a condo tower

Behind The Curtain

While Avraham has served as the public face of Olympia Heights Management, alongside Eugene Zlatopolsky, who signed the loan agreements for the mortgages, a New York developer with a spotty reputation is involved in the company.

Cooperman confirmed to Bisnow the Boymelgreen family was involved in the project. And Sarah Boymelgreen, the wife of Shaya Boymelgreen, is the authorized signatory for the LLC registered with Georgia for the property — OHM Atlanta Owner — according to state documents.

The Boymelgreen name is well-known in New York real estate circles. According to the New York Times, patriarch Shaya Boymelgreen’s “break came in 2001” when he met diamond magnate Lev Leviev, and they built more than 2,400 apartments together.

By 2009, the Israeli-born Boymelgreen had trimmed his staff to 15 from 200, was in the process of being evicted from his Brooklyn office and was already facing lawsuits from his buyers over unfinished work at their buildings.

The New York Attorney General’s office starting investigating him in 2013. In 2016, Boymelgreen entered into a settlement agreement with then-Attorney General Eric Schneiderman. The deal meant Boymelgreen couldn’t sell any condos in the city for two years. Boymelgreen also agreed to repair issues at six of his projects.

The settlement put “an end to Mr. Boymelgreen’s perpetual fraud and abuse in New York City real estate securities,” Schneiderman said at the time.

The investigation found that Boymelgreen and Leviev had, in one instance, made $360M by selling out a Lower Manhattan condo project, 15 Broad, then “abandoned efforts to finish the work and drained the escrow funds, while assuring buyers that the money had been set aside,” the Times reported.

While Boymelgreen was being investigated in New York, his Olympia Heights company was pitching No2 Opus Place. While multiple people involved in the project have confirmed then Boymelgreens’ involvement in No2 Opus Place, they have not been mentioned in any of Olympia Heights’ public statements or plans.

“That’s part of some of the challenges with the site,” a source close to the project, who was not authorized to speak to press, told Bisnow. “If you’re the developer and you have a questionable equity partner, you’re going to do all you can to defer attention away from that partner.”

Bisnow offered numerous opportunities to Olympia Heights Management for further comment on the story.

“They don’t do press,” Lane said.

What Comes Next

Yates Construction was recently tapped to perform site work for No2 Opus Place, a move that spawned local chatter that perhaps the tower was finally breaking ground. But a source familiar with the contract said Yates is undergoing design assist work, in which it is assessing the potential cost to develop the project, as well as digging out dirt at the site all the way to the bedrock.

No one has been hired as a general contractor as of press time. Officials with Yates Construction declined to comment.

A handful of senior real estate professionals told Bisnow that Olympia Heights and Berkshire Hathaway have used activity on the site in its marketing outreach to insinuate that actual construction had begun.

The No2 Opus Place sales office posted a 28-second video to YouTube in December 2017 called “No2 Opus Place Groundbreaking” that shows dirt shooting out from the ground like geysers, but no people or construction equipment on the site. Another video, posted in July, shows excavators hauling dirt into trucks. The page has not been updated in 11 months.

The repeated false starts have made it difficult for brokers to sell their clients on committing to a unit at the project. One broker, who spoke on the condition of anonymity, said she had a client back away from putting a down payment on a unit.

“I did have one person make an offer. [But] they got cold feet because they felt they weren’t getting a straight story from the sales office,” said the broker, who has sold homes in Atlanta for 20 years. “It was really just based on lack of confidence in the sales office.”

If clients ask today about No2 Opus Place, the broker said she still takes them to the sales office, but will have a word of caution after the tour.

“I [tell clients], ‘Let’s go have a look,’” she said. “And then I tell you, ‘Let me be honest with you. I don’t think that project is going forward.'”

The site was quiet when Bisnow visited it this week, a digger sitting idle on the dirt. It had been raining the previous day, and it would shower later that afternoon as well.

But there were signs that at least some work had recently been done. Olympia Heights’ contractor had dug the hole where No2 Opus Place is supposed to go even deeper.

If you have bought a unit at No2 Opus Place or represent clients who have been interested in the site, email Jarred Schenke at jarred@bisnow.com. All correspondence will be kept confidential.

June 20, 2019

/cdn.vox-cdn.com/uploads/chorus_image/image/64056958/Screen_Shot_2019_06_21_at_1.54.29_AM.0.png)

/cdn.vox-cdn.com/uploads/chorus_image/image/64016307/Ansley.0.jpg)

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/16348789/Screen_Shot_2019_06_17_at_9.32.07_AM.png)

/cdn.vox-cdn.com/uploads/chorus_image/image/64017699/Emory2.0.jpg)

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/16330052/MidtownHotelBar.jpeg)

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/16330055/MidtownHotelLounge.jpeg)

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/16330053/MidtownHotelLobby.jpeg)

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/16330056/Woof.jpg)